Am I charging enough for my products/services?

There is both an art and a science to properly pricing your products or services (let’s refer to both products and services as “products” for ease of conversation). When done properly, pricing is a combination of the costs associated with providing the product and how the market will respond to what you are offering.

Let’s look at the market first. There are two characteristics that will affect what you can charge for your product.

To improve your pricing, you must shift your product from being a commodity to something unique through differentiation. Ask yourself these questions:

You need to change how customers perceive your product so they see it as distinct from the competition.

Calculating the cost of providing your product is the science behind pricing.

The first rule is: You must know all of your costs. It is surprising how many business owners have no idea what costs go into providing a product for sale.

Here are a few cost categories:

Biggest Mistake in Pricing

What is the biggest mistake I’ve seen business owners make when pricing their products? Not including the cost of their own time and effort. If you don’t expect to be paid, why are you working so hard?

Do I need to have a cash reserve, and if so, how much?

Absolutely, every business should have a cash reserve. The future is uncertain—things may be better or worse than they are right now. A cash reserve allows you to take advantage of opportunities when things go well and weather the storm when they don’t.

As for how much, that depends on your business model. Businesses with substantial infrastructure will need more cash reserves than those with fewer physical assets. Typically, I recommend setting aside 3 to 6 months of operating expenses.

Your reserve amount may include all wages, some wages, or none. If your industry has regular, periodic slowdowns, use the duration of those slowdowns as a guideline for the size of your cash reserve.

A useful metric to monitor your cash reserves is Days Cash on Hand, which helps assess how well your business is managing its cash.

What is a Board of Advisors?

Being the boss is a lonely job. Often, there is no one within your business to whom you can turn and be completely vulnerable. On top of that, running a business is complex, requiring a wide range of specialized skills that are rarely found in a single person.

A Board of Advisors consists of individuals with expertise in areas where you need support. They provide valuable resources and insights that allow you to focus on what you do best. Even having someone with similar skills but a different perspective can be invaluable.

Some areas of expertise a board of advisors may cover include:

An added benefit: Board members can be family members. Including your children on the board of advisors not only teaches them valuable skills but also allows you to compensate them, funding their retirement and spending money through the business rather than out of your personal pocket.

What is the most important system a business should have?

Without a doubt, the most important system in your business is your sales funnel. Without a clear understanding of where your next customer is coming from and how much it will cost to acquire them, your business will struggle.

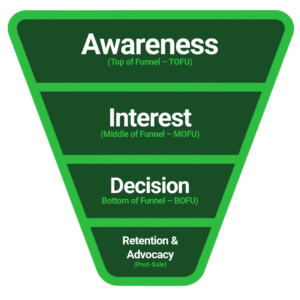

A sales funnel consists of four stages:

Each stage may include multiple steps, depending on how your business interacts with leads, prospects, and customers.

An effective sales funnel should have:

Drop-off rates (the expected percentage of people who do not move forward)

Am I charging enough for my products/services?

There is both an art and a science to properly pricing your products or services (let’s refer to both products and services as “products” for ease of conversation). When done properly, pricing is a combination of the costs associated with providing the product and how the market will respond to what you are offering.

Let’s look at the market first. There are two characteristics that will affect what you can charge for your product.

To improve your pricing, you must shift your product from being a commodity to something unique through differentiation. Ask yourself these questions:

You need to change how customers perceive your product so they see it as distinct from the competition.

Calculating the cost of providing your product is the science behind pricing.

The first rule is: You must know all of your costs. It is surprising how many business owners have no idea what costs go into providing a product for sale.

Here are a few cost categories:

Biggest Mistake in Pricing

What is the biggest mistake I’ve seen business owners make when pricing their products? Not including the cost of their own time and effort. If you don’t expect to be paid, why are you working so hard?

Do I need to have a cash reserve, and if so, how much?

Absolutely, every business should have a cash reserve. The future is uncertain—things may be better or worse than they are right now. A cash reserve allows you to take advantage of opportunities when things go well and weather the storm when they don’t.

As for how much, that depends on your business model. Businesses with substantial infrastructure will need more cash reserves than those with fewer physical assets. Typically, I recommend setting aside 3 to 6 months of operating expenses.

Your reserve amount may include all wages, some wages, or none. If your industry has regular, periodic slowdowns, use the duration of those slowdowns as a guideline for the size of your cash reserve.

A useful metric to monitor your cash reserves is Days Cash on Hand, which helps assess how well your business is managing its cash.

What is a Board of Advisors?

Being the boss is a lonely job. Often, there is no one within your business to whom you can turn and be completely vulnerable. On top of that, running a business is complex, requiring a wide range of specialized skills that are rarely found in a single person.

A Board of Advisors consists of individuals with expertise in areas where you need support. They provide valuable resources and insights that allow you to focus on what you do best. Even having someone with similar skills but a different perspective can be invaluable.

Some areas of expertise a board of advisors may cover include:

An added benefit: Board members can be family members. Including your children on the board of advisors not only teaches them valuable skills but also allows you to compensate them, funding their retirement and spending money through the business rather than out of your personal pocket.

What is the most important system a business should have?

Without a doubt, the most important system in your business is your sales funnel. Without a clear understanding of where your next customer is coming from and how much it will cost to acquire them, your business will struggle.

A sales funnel consists of four stages:

Each stage may include multiple steps, depending on how your business interacts with leads, prospects, and customers.

An effective sales funnel should have:

Drop-off rates (the expected percentage of people who do not move forward)

If you didn’t find the clarity you were looking for, let’s talk it through.

Book a Discovery Call — and together, we’ll uncover your next step toward profit, peace of mind, and living a life of meaning.

253-289-5151

interest@profitarch.com

Located in the great Northwest; Serving the Nation

Copyright © 2021-2025 | ProfitArch™, All rights reserved. Website Design & Development by Viim